President Al-Alimi Directs Completion of Investigations into Corruption Cases Under Review by Oversight Agencies and Law Enforcement Authorities

Aden

The Yemeni News Agency (Saba) has learned that the Presidential Leadership Council has initiated coordinated measures with all relevant entities to combat corruption, money laundering, terrorism financing, and to protect public funds and the State’s legal position.

The Presidential Leadership Council received reports from law enforcement and oversight authorities concerning pending cases. President Dr. Rashad Mohammed Al-Alimi, President of the Presidential Leadership Council, based on the council’s recommendations, directed the expedited completion of investigations into all cases and the identification of entities failing to cooperate with oversight mechanisms.

The Council stressed the importance of referring all cases under review by oversight authorities to the judiciary for legal proceedings, pursuing suspects domestically through specialized agencies and internationally via Interpol.

The Public Prosecution revealed that legal action has been initiated in over 20 cases related to corruption, embezzlement of public funds, money laundering, terrorism financing, harming state interests, tax and customs evasion.

A report from the Attorney General’s office highlighted that the prosecution, as the competent entity for initiating legal proceedings, safeguarding public funds, combating terrorism and money laundering has taken legal measures in several complaints and reports.

The cases include corruption in contracts for vital projects, energy generation leases, public fund wastage, state land encroachments, use of forged documents, customs evasion, terrorism financing, and attempts to illegally acquire petroleum products.

The report also indicated that several cases have been referred to public funds courts, which have already ruled on four cases involving non-compliance by banks and exchange companies with anti-money laundering laws and practicing money exchange without license. These rulings included fines amounting to millions of riyals and mandates to comply with financial information unit requests.

Other cases still under review include contracts for the Aden Refinery Power Plant project and facilitation of land acquisition in the Aden Free Zone.

According to the report, the Public Prosecution has acted on several cases under its review through a series of urgent legal measures and interventions to safeguard public funds. Additionally, it has referred other complaints, reports, and cases under investigation to the Central Organization for Control and Auditing and relevant entities to provide further evidence, reports, and necessary documents for proceeding with legal action.

The Public Prosecution lamented the lack of cooperation from certain ministries and government entities, which has delayed progress on several cases under investigation.

One highlighted case involves a former governor accused of harming state interests and customs evasion, with 27 billion riyals of his frozen assets and ongoing legal efforts to recover embezzled public funds.

Counter-Terrorism:

On the foreign regard and international cooperation, the Public Prosecution reported receiving requests to freeze assets of entities and individuals linked to money laundering and terrorism financing. The Persecution affirmed that decisions to freeze accounts were issued in cases involving individuals associated with the Houthi militia. However, some requests were denied due to insufficient evidence. The prosecution is working with the U.S. Treasury Department to obtain additional data and evidences related to the detaining decisions, especially regarding entities, natural and legal individuals in liberated areas.

Furthermore, the results of audits and reviews conducted by the Central Organization for Control and Auditing on the accounts of several government entities revealed numerous financial and administrative violations and irregularities, which have cost the state treasury hundreds of millions of dollars over the past years.

Central Bank Operations, Consular Revenue, and Electricity Derivatives

Saba News Agency reviewed six COCA reports assessing the Yemeni Central Bank’s performance since its relocation to Aden in 2016, the financial operations of Yemeni consulates in Jeddah, Jordan, and Egypt (2016–2023).

The reports also included the results of reviewing and evaluating the processes for securing petroleum products for the electricity sector through the Fuel Procurement Committee for Power Plants in 2022. Additionally, they covered the available documents and details of contracts signed by Aden Refinery Company with the Chinese company Shanghai Turbine, as well as the procurement processes for the two ships, Amira of Aden and Lulu of Crater, and activities in the Aden Free Zone.

Regarding the Consulate General in Jeddah, the Central Organization for Control and Auditing revealed that the audit uncovered numerous violations and irregularities related to the collection of revenues, consular fees, and their disbursement.

Among these violations was the imposition of an increase in fees for issuing ordinary passports by the Supreme Committee for Passports, with a portion of the public revenue allocated to cover the costs of committees from the Ministry of Foreign Affairs and the Immigration, Passports, and Nationality Authority, as well as additional income for the Consulate General in Jeddah, all without any legal basis.

The COCA reported that the total amount disbursed in this manner reached 91,236,000 Saudi Riyals.

The report also concluded that the consulate failed to remit the revenues collected from ordinary passport issuance fees and associated penalties for the period from early 2018 to the end of 2022, amounting to 156,656,000 Saudi Riyals. It noted that only 12,750,000 Saudi Riyals were deposited as public revenue.

Regarding the Yemeni Embassy in the Arab Republic of Egypt, the report revealed that employees embezzled $268,000 from consular revenues by falsifying official documents. This involved issuing passports under the occupation of “student,” despite prior knowledge of the inaccuracy of the occupation. Full passport fees of $95 were collected, while only $27 per passport was recorded in the automated system and actual reports, leading to consular revenue being reported at significantly lower figures than what was actually collected from citizens. The report also highlighted other violations related to the misuse of privileges granted to the embassy and members of the diplomatic corps.

The Central Organization for Control and Auditing also uncovered numerous violations and breaches of laws and regulations concerning all contracts related to the provision of petroleum products in 2022, valued at $285 million. These actions caused harm to public funds by inflating the financial burdens borne by the state treasury and prioritizing the interests of the contracted companies over public interest.

The COCA reported that its review of Aden Refinery Company’s contracts with a Chinese company revealed wastage of public funds through projects contracted with the company at a total cost of $180,543 million under the pretext of refinery modernization, despite the lack of actual need for these projects.

The COCA further pointed to multiple violations and irregularities accompanying the procurement and operation contracts for the two ships, Amira of Aden and Lulu of Crater, as well as the costs of chartering ships to transport petroleum products. These actions resulted in significant financial losses and the squandering of the company’s assets.

Regarding the Aden Free Zone, the COCA concluded that its leadership facilitated the illegal appropriation and trade of its lands by approving transactions conducted by some investors. These transactions included the unauthorized sale and purchase of Free Zone lands, under the guise of transferring projects or allocating plots of land to the public, among other violations.

The Floating Vessel:

A report from the Central Organization for Control and Auditing concerning the review of the preliminary documents for the contract to purchase 100 megawatts of electricity from a floating vessel operated by Prism Enterprises has unveiled numerous irregularities and violations associated with the contracting process. This contract was initially intended to last for three years, with a total amount of $128,056,800.

The COCA indicated that, based on its examination of the documents related to the electricity purchase contract for the floating vessel, it concluded that the officials managing the electricity sector and relevant parties approved and endorsed the contract while incorporating certain unfair clauses or conditions. These actions appear to prioritize the interests of the contracting company over the public interest.

The COCA’s report confirmed that the contracting process was executed in an unstructured manner, without adequate consideration of the associated risks. In this context, it emphasized that the electricity sector was obligated to pay 20% of the contract value in advance payment (10% for the electricity purchase contract and 10% for the substation and transmission lines), amounting to a total of $12,805,680, before the arrival of the floating vessel. This payment was made without securing any bank guarantees, despite the contracting company's commitment to provide such assurances. This situation jeopardizes the electricity sector's rights to receive appropriate compensation in the event of a breach of contract by the aforementioned company.

Reports from the COCA and the High Authority for Combating Corruption indicated that the contract involved violations of the Law on Tenders, Auctions, and Government Warehouses, which mandates that contracts for supply, works, maintenance, repair, consulting services, and other services must be awarded through a public tender announced either nationally or internationally.

The reports highlighted that the competition for the mentioned contract was restricted to a limited number of companies, thereby excluding opportunities for all specialized firms in this field. This practice contradicts the principles of fairness, equity, and the provisions of applicable laws and regulations.

The reports stated that such an approach deprives the electricity sector of potential cost savings in pricing and specifications by not allowing a broader range of companies to compete. Furthermore, executing the contract through a limited tender under the pretext of quickly providing energy is inconsistent with the actual procedures, which took over two years to complete.

The reports also noted that the contract conferred tax exemptions to the contracting company, including exemptions from income tax and customs duties.

According to the COCA, the contract was signed on April 6, 2022, and the letter of credit was opened on November 7, 2022, alongside the payment of the advance amount and the expiration of the designated period for initiating operations at the plant. However, it was observed that the aforementioned company delayed the arrival of the floating vessel and the operation of the plant, with electricity sector officials failing to hold the company accountable for all compensations and penalties stipulated in the signed contract. This situation has led to the continued renewal of previous power purchase contracts for diesel-powered generation plants, exacerbating the financial burdens on the public treasury due to discrepancies arising from the global increase in diesel fuel prices and elevated consumption rates, averaging over $107 million annually.

The report of the COCA revealed that among the violations outlined in the contract, the electricity sector was required to pay $17,856,600 for the construction of transmission lines and the substation, exceeding the originally specified value by over $10 million based on bids from other companies. This resulted in a significant waste of funds without justification, in addition to the potential for contracting directly with specialized companies for the purchase of the plant and the lines.

The report also emphasized that the contract signed with the aforementioned company did not include any commitments or conditions to obligate the company to bear all liabilities or losses arising from environmental damages. Furthermore, there was no assurance that the company would provide all necessary measures and requirements to protect the marine environment from waste generated by energy production. This oversight could potentially harm fishery resources, which are a significant source of national income.

PetroMasila:

In the context of reviewing and evaluating the performance of PetroMasila, reports from the Central Organization for Control and Auditing, along with other official documents, have revealed a series of violations and breaches committed by the company, established in 2011 to operate the oil sector in Block 14 in the Masila region. Among these issues is the company's deviation from its core responsibilities of developing the oil industry, shifting instead towards other projects such as contracting and construction projects.

The reports indicate a lack of transparency regarding the activities undertaken by the company, as all its operational programs and annual budgets have not been subjected to review. Furthermore, financial information remains withheld from the Ministry of Oil and the General Authority for Exploration and Production of Oil to this day.

The reports confirm that the company has not been subjected to any oversight or supervision from the Ministry of Oil or the Central Organization for Control and Auditing. Additionally, it has failed to submit any annual budgets for review by an accredited auditing body during its continuous operation over the past 13 years.

According to these reports, the company has exceeded its defined operational scope established in the founding decision for Block 14, extending its activities to other oil Blocks. The decision to establish PetroMasila does not grant it the authority to operate beyond the Block for which it was established.

The reports stated that PetroMasila established a company in the Sultanate of Oman with significant capital and another in the Bahamas under different names, without any evidence confirming that these companies are state-owned.

Among the violations outlined in these reports is PetroMasila's payment of $7 million to acquire 15% of the contractor's stake in Block 5, in exchange for assuming part of its financial obligations to the government and other parties, which are estimated to be in the hundreds of millions of dollars. This occurred despite the fact that the stake's owner had previously offered it at no cost.

The reports indicate that since PetroMasila assumed management of the oil sectors in Hadramaut and until the halt of export operations, the company has exported crude oil from the ready and producing blocks, earning approximately $30 million for each shipment, totaling $1.2 billion, which has been transferred to its accounts abroad.

It was added that "given that the blocks were ready for production and have not witnessed any exploratory or developmental activities by the company, the operational costs were limited to salaries and other expenses, which do not exceed 25% of the value of the oil sold." This raises questions about the fate of the remaining revenues.

The report expressed surprise at the absence of an office for the company in the interim capital, Aden, noting that its headquarters is still in Sana'a, which is under the control of Houthi militias.

The reports noted that PetroMasila is the only national company that has taken on six production blocks, in contrast to other national companies, despite the lack of tangible results in developing its blocks or increasing production.

The reports detailed instances of PetroMasila drilling wells without obtaining the necessary approvals from the Oil Exploration and Production Authority, noting that the results of these efforts were unsuccessful.

It disclosed that among these were wells for which the Oil Exploration and Production Authority had previously denied approval during the tenure of the former foreign operator in blocks 14 and 10. These actions represent clear violations of the law, resulting in significant financial losses estimated in the tens of millions of dollars.

State Lands and Properties

Subsequently, His Excellency President Dr. Rashad Mohammed Alimi, President of the Presidential Leadership Council, directed the assignment of a specialized team from the Central Organization for Control and Auditing to evaluate the performance of the General Authority for State Lands and Properties over previous periods, as well as the extent to which its activities comply with the State Lands and Properties Law and its executive regulations.

Reports by the Central Organization for Control and Auditing revealed systematic encroachments and random seizures affecting extensive areas of state lands and properties, carried out by armed groups affiliated with influential figures. These actions have exploited the ongoing state of war and instability that the country has been experiencing for several years.

The COCA stated that it has identified approximately 1,929 cases of encroachment currently pending before the judiciary at various levels, affecting lands covering an area exceeding 476,758,095 square meters across the liberated governorates, in addition to unreported encroachments.

The report also addressed violations and illegal actions by government entities that facilitated the appropriation of state lands and properties, resulting in the handover of extensive areas, including unplanned lands to investors who failed to implement the projects for which the lands were allocated.

In this context, the report provided several examples of local authorities handing over areas of land totaling millions of square meters for projects in which investors have proven insincere in their execution. Despite presidential directives to annul all unlawful actions, the authorities in the governorates have taken no measures in response.

The violations included granting ownership of state lands to non-Yemenis and registering them in the land registry using invalid documents and fabricated rulings. Additionally, there were alterations to official plans aimed at appropriating service areas designated for public facilities, as well as facilitating transfers of large areas of agricultural land for residential, commercial, and investment purposes.

According to the report by the Central Organization for Control and Auditing, acts of encroachment and looting have affected 25 state-owned farms, including all their contents and assets such as artesian wells, machinery, and other equipment, in the governorates of Lahij and Hadhramaut Valley, covering a total area of 62,844 acres. Additionally, there have been serious violations and infringements on state lands in Taiz, Abyan, and other governorates.

The report indicated that the violations against state lands included public streets, the appropriation of spaces in front of commercial establishments, and the construction of buildings, hangars, kiosks, and warehouse facilities.

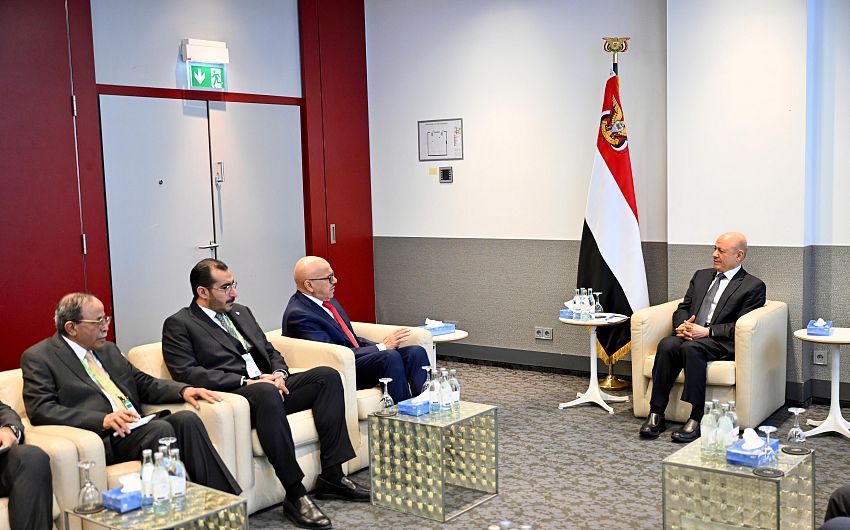

President Al-Alimi in Address to the Nation: Restoring Sana’a and a Just, Greater Yemen Will Remain a Collective National Goal

President of the Presidential Leadership Council, Dr. Rashad Mohammed Al-Alimi, called on the Yemeni people to seize the opportunity presented by the new transformations